How we work

Gather data//

Communities often use data that is outdated. We place a priority on collecting data that is as current as possible. We use interviews and surveys along with publicly available sources of data like the BLS to build our baseline models.

Measure//

We combine disparate data that tells the story of the ecosystem from the entrepreneur’s perspective. We use this as baseline for metrics going forward and as a tool to begin a conversation around community vision.

Vision//

We think great visions have a 20-year focus, are uniquely built by the community using data, have meaning metrics and milestones, and are renewed and reevaluated each year allowing for change and growth.

Strategic action plan

Many communities ask how to begin? The reality is most have already started, but lack coordination. Many operate independently in silos treating symptoms and not causes. Or support systems provide duplicate or outdated services that are irrelevant to today’s entrepreneurs. The best way to support early stage founders is to be a first customer.

Implementation//

Find your entrepreneurs because they are the ones who will tell you what is working and what needs to be fixed. Most communities have similar go to market strategies that aren’t based upon recent data, don’t measure development across interrelated systems, and don’t include the perspectives of local entrepreneurs. Any strategy that doesn’t find and place entrepreneurs front and center will struggle to gain traction, start new businesses, and create additional wealth for a community.

growth//

In the Midwest reaching critical mass is difficult because of population density or a lack thereof. This makes regional network development and important part of the growth component. Finding regional partners and customers helps both communities and companies scale smartly.

Investing in Entrepreneurship to create Net New Wealth

Entrepreneurship can be difficult to measure for many reasons, but one primary reason is that the life of an economic venture is much more unpredictable than the life associated with a building. However, the unpredictability of entrepreneurship is also one of its primary benefits as it is one of the few (if not the only) means for an economy to radically shift the economic well-being of the residents. Unlike tax incentive based attraction, new businesses generate 1) wealth for the owners and often many other players associated with the businesses, 2) taxes because rarely do these companies account for tax incentivized behavior, 3) new jobs, the Kauffman Foundation has produced numerous research studies that show that young companies (those under five years old) produce ALL of the net new jobs in the country, 4) investment from outside of the region. This investment can come in the form of venture capital and other risk based investments, but often comes from exporting goods or services and importing money. An economy is fundamentally about this importation of wealth. That wealth can be transmitted in talent, currency, products/services/expertise, and other means.

We strive for directionally

forward movement.

Right-ish Metrics

YEAR by YEAR GROWTH

The math to measure an entrepreneur ecosystem is imperfect. We have developed a system utilizing key indicators that enable us to get the measurement right-ish. This means our metrics are current and directionally correct allowing us to identify right-ish causation . Many alternative methods available utilizes data sets from up to 3-5 years ago which poses a problem to making decisions for the ecosystem you have now. By creating our own proprietary economic analysis tool we have been able to provide measurements that are current so communities can identity critical gaps in real-time.

When we work with clients or goal is to create baseline metrics, coupled with a mission and vision, to build a strategy and create year by year growth in the right direction.

The key to an economic impact study is to measure how something causes wealth to be created.

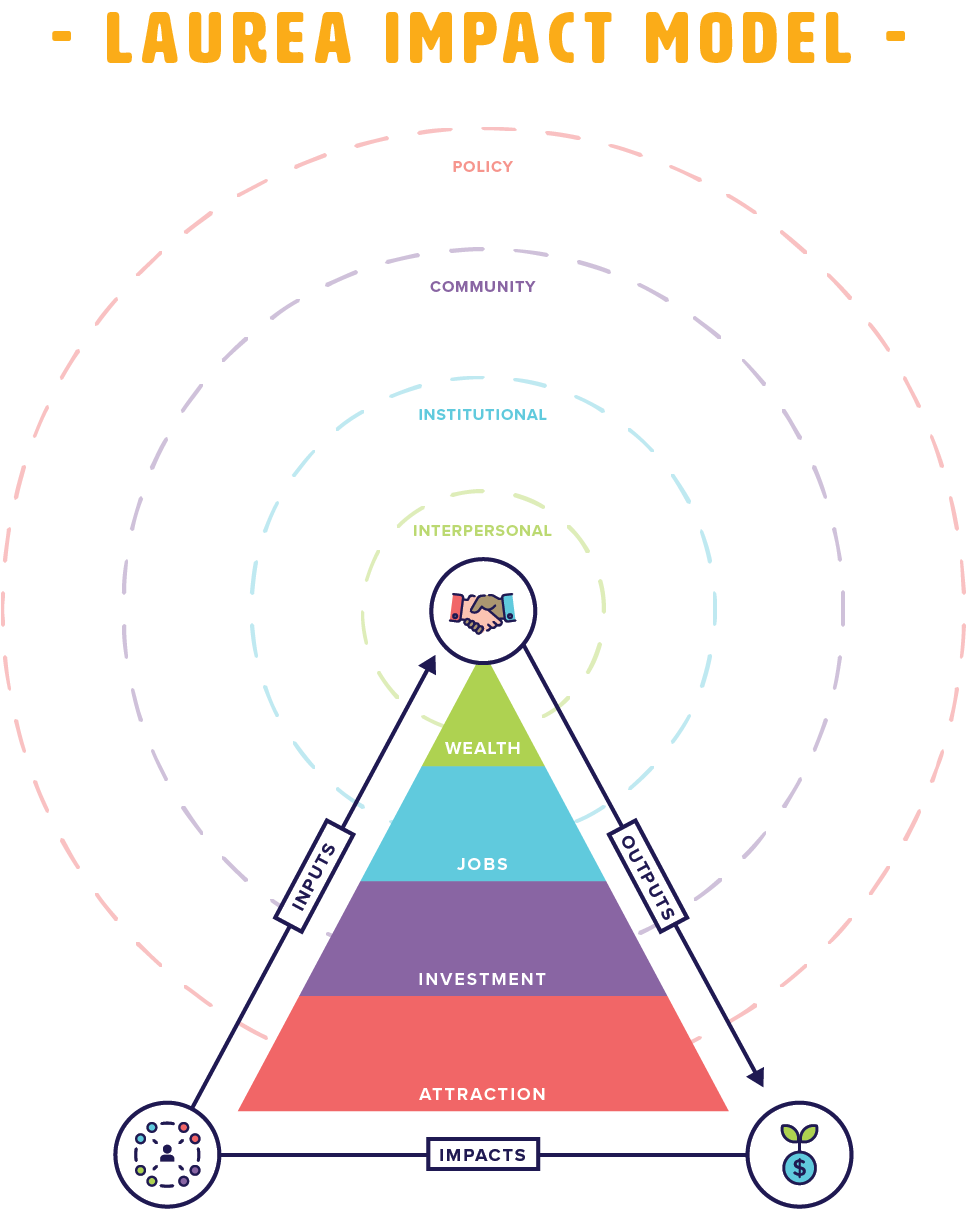

Chapman and Company’s proprietary model, Longitudinal Analysis Of Urban Regional Entrepreneurial Activities (LAUREA), is used to illustrate the economic impact of entrepreneurial ecosystems on cities and regions. LAUREA measures wealth creation using economic tools tied to entrepreneurial activity.

Like other economic impact models (RIMS, IMPLAN,etc.), the premise is that certain inputs – in this case entrepreneurial activity – produce economic outputs – jobs, investment, and wealth. To date, there has not been a model that is used consistently by economists to illustrate the significant impacts of entrepreneurial ecosystems on local geographies. However, intuitively policy and place makers are aware of the powerful gravitation pull of strong entrepreneurial communities. These communities represent the best of the United States when it comes to culture, creativity, innovation, and talent attraction. As magnets, strong entrepreneurial ecosystems also produce outputs – wealth, jobs, and investment – that need to be measured.

LAUREA, the Longitudinal Analysis of Urban Regional Entrepreneurial Activities, uses a picture of entrepreneurial activity over time from sources such as SBA Loans and Pitchbook investment data to begin to identify the key inputs into an economy from entrepreneurs and their activities. These inputs have specific multiplying effects based on the type of industry and the type of jobs created. For example, RIMS II, another economic input-output model will adjust its multiplying effect based on type of job, geography (cost of living), wages, and other factors. So, construction jobs will add 1.5-2x the amount of economic activity as the simple wage. That money gets recirculated into the economy via a number of spending behaviors (buying groceries, rent, etc.).

Wealth//

The fundamental goal of economic development is to build community wealth.

Jobs//

All net new job growth in the U.S. occurred in companies less than five years old. (Kauffman Foundation)

Investment//

Measure investment in a variety of ways — including bootstrapping, grants, debt, and equity

Attraction//

A robust ecosystem starts to attract interesting people — talent — and additional companies.

ready to have a conversation?

Contact us!